The Ultimate Mutual Fund Explainer

Want to invest in Mutual Funds but don't know where to start? This comprehensive guide on Indian equity mutual funds will help you begin and build an ideal portfolio.

It’s been a while.

The last couple of months have been busy yet enjoyable. With a return to offline college and an internship underway, I kept procrastinating work on the newsletter. A week’s delay became a month and soon I lost track.

The last couple of months have also seen the markets traverse a topsy-turvy path. From an all-time high in mid-October to the first significant correction in the last 18 months, it has certainly been an interesting phase.

With so much happening, the urge to get back to writing finally surpassed the college student’s urge to procrastinate. And so here I am.

I am going to resume with a topic I feel is really important but nobody talks about enough.

While direct equity investing has always been the way investors amass wealth, in the last couple of decades, mutual funds has emerged as an instrument where systematically and with much lesser hassles and time expenditure, a satisfactory corpus can be built. But there’s a concerning trend going on at the moment.

“Mutual Fund Sahi Hai”

You’ve probably been bombarded constantly with this line in the last 12-16 months. MS Dhoni, Sachin Tendulkar, and many other cricketers have been hell-bent on making you believe

“Mutual Fund Sahi Hai”

And undeniably, this campaign kicked off by the Association of Mutual Fund in India(AMFI) has been a success. Mutual Funds have emerged as the most popular and efficient means for the common man to invest in the stock market. As of 31st July 2021, the Indian mutual fund industry had 35 trillion INR assets under management with more than 10cr accounts. This campaign has only further driven the point home.

However, there is a follow-up question that nobody in the ad asks Dhoni or Sachin.

“Kaunsa mutual fund sahi hai?”

There are 2500+ mutual fund schemes in India across 25 categories. And each category offers different returns, risks, and diversification. It is a common practice to invest in funds of popular fund houses or through recommendations of family and friends or brokers. However, arbitrarily investing in such funds may not be in line with your goals and risk appetite.

Individuals spend truckloads of time researching individual stocks. But barely a fraction of that on mutual funds. While there are certainly lesser variables to keep in mind while investing in an MF, basic analysis and understanding could result in a significantly better yield.

In this edition, I will be shedding light on

Categories of equity mutual funds

When to invest in a particular category

Strategies to build a well-rounded mutual fund portfolio.

Let’s get started.

I hope this piece brings some value to you as well as him:

I] Categories of equity mutual funds

Equity Mutual Funds in India can be divided into 2 broad categories:

Funds based on Market Capitalisation

Funds based on Objective

Both these categories have 5-6 primary funds. There are a lot more variations as well, but an understanding of the primary ones should help you understand the rest as well.

Based on Market Capitalisation

To understand the various types of funds in this category, you only need to know the concept of market capitalization. Market cap is nothing but the price of 1 share of the company x the total number of shares of the company. In simple language, the total value of the company. For context, Apple and Microsoft have a market cap of more than $2 trillion. They are the biggest companies in the world by market cap.

Companies are divided into primarily 3 categories Large Cap, Mid Cap, Small Cap. All countries have different principles for this division. In India, this division is as follows

Small Cap: Market Cap < 500cr

Mid Cap: 500cr<Market Cap<20000cr

Large Cap: Market Cap>20000cr

With this information, we can easily understand the division

Large Cap Funds: Focus on the blue-chip i.e the largest, most reliable, and stable companies of the stock market. In India, companies such as Reliance, TCS, Infosys, HDFC Bank which have been around for a long time and have been safe bets, are included in these funds.

Mid Cap Funds: These funds consist of growing companies that could graduate to becoming large cap companies. A few popular names in the market are Tata Power, Federal Bank, IRCTC, etc. They are less reliable in terms of constant earnings growth than large-cap companies but offer the possibility of a higher return.

Small Cap Funds: These funds have companies whose stock movements are volatile. JustDial, Westlife Development, and Indian Bank fall into this category. There is tremendous scope of growth for these companies and hence higher possibility of handsome returns as compared to the other 2 types. But the drawdown and risk are also much more severe.

Large and Mid Cap Funds: These funds have a combination of large and mid cap companies.

Multi Cap Fund: As the name suggests, this fund has the liberty to pick stocks from all three types. However, this choice is made in line with certain rules.

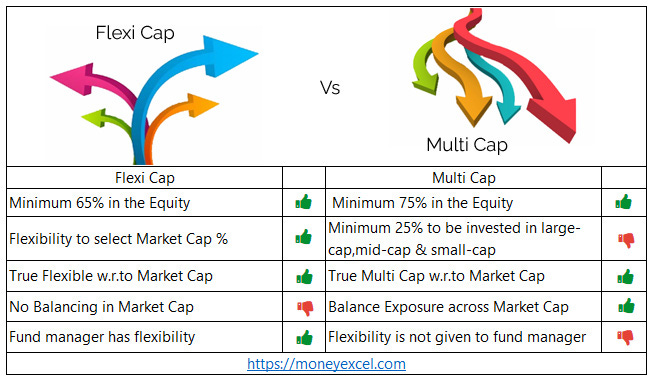

Flexi Cap Fund: A category introduced not very long back, it is a more flexible variant of the multi cap fund. This image should make the distinction very clear

This covers our first main category. Now let’s move on to the second category.

Based on Objective

Here the market capitalization isn’t of much significance. Rather the funds are based on a particular theme.

Sectoral Funds: These funds track a particular sector. For example, some funds track the IT sector which consists of Infosys, Wipro, TCS amongst others. Similarly, funds are tracking Banking, FMCG, etc. These are a good bet when you feel a particular sector is going to boom.

Value Funds: These funds consist of stocks that the fund manager feels is fundamentally sound and presently undervalued. Hence the performance of these funds is based on the fund manager’s analysis and the assumption that the market will eventually price those stocks correctly. It’s a tricky fund to invest in, but a good manager could do wonders.

Focused Funds: Focused funds look to invest in a relatively smaller number of securities to create a balance between diversification and concentration. The securities could be from multiple sectors and markets. For example, SBI Focused Fund’s holdings include Bharti Airtel, HDFC Bank as well as Netflix.

Dividend Yield Funds: As the name suggests, these funds invest in companies that provide a dividend yield. Hence it doesn’t come as a surprise that HDFC Dividend Yield Fund and other similar funds hold companies like Infosys, ITC, HUL, companies which have historically always returned a good yield annually.

Contra Funds: Fund managers of these funds take a contrarian viewpoint. For example, if the technology sector is booming while the financial stocks are down, they’ll take a larger position in the financial sectors betting on the fact its fortunes will reverse. Of course, they don’t punt based on pure instincts. There is heavy research that goes behind their buying, but the theme is usually against the prevailing market trend. Naturally, the risk of underperformance might loom but if they get their strategy right, it could also lead to eventual overperformance to the market.

ELSS Funds: Equity Linked Savings Scheme funds are an interesting mix of tax saving and investing inequities. ELSS funds have a lock-in period of usually 3 years. According to the schemes, you can reduce up to 1.5L rupees invested in ELSS funds from your taxable income.

I hope that now you understand the chunk of the equity mutual fund categories in India and the options you have. If there are doubts that have arisen after reading this, you can always reach out to me.

II] When to invest in a particular category

Now is the time to understand how to create an ideal mutual fund portfolio. In my opinion, you need to analyze and assess 3 primary themes.

Time Horizon

Risk

Macrotrends

A] Time Horizon and Risk go hand in hand. The more your time horizon increases, the easier it is for you to ride the volatility and mitigate the risk.

But if you see risk in isolation, it is clear that small-cap funds are riskier than large-cap funds while offering the possibility of a higher return.

Let’s look at data. In the last 2 years, NIFTY 50, which consists of large-cap companies has given around 46% returns, On the other hand, NIFTY Smallcap 100 has returned a whopping 97%.

While this may make you inclined towards investing in only small cap funds, here is the other side.

From Jan 2018 to Dec 2018, NIFTY returned only around 3%. Quite less right? Well NIFTY Smallcap 100 in the same period, crashed by 28%. Now the positive 3% return doesn’t seem too bad, does it?

The bottom line is large cap funds will not have extreme movements, on the upside or downside. Small cap funds will relatively have a lot more. If you have the stomach to hold on for longer, then probably small cap works, if you feel the volatility could give you restless nights, probably a safer option of large cap funds works.

Mid Caps are neither here nor there. It is not a thumb rule that their volatility and returns would fall in the middle of those of small-cap and large-cap. It may be the case, but you would be better served looking through the past returns of mid caps to have a better idea.

B] The understanding of macro trends helps in choosing objective-based funds.

In April 2020, when the pandemic had set in and lockdowns were enforced, which sectors would have been good choices. Pharma because they were now going to be in overdrive? Tech because everything had moved online? If these questions would have popped into your mind and you would have made investment decisions based on them, you would have made 68% on NIFTY Pharma and 135% on NIFTY IT in the last 24 months.

Which sector would have suffered? Banks because there was financial instability and nobody was taking loans? Nifty private banks index has returned only 8% in the same period.

While I don’t claim this line of thinking will always get you returns but surely they help you in identifying themes and picking objective-based funds.

III] Strategies to build a well-rounded mutual fund portfolio.

“So, now after all this, will you actually tell us how to build a portfolio or not?”

It might sound cliche, but there is no definitive, overarching strategy for all. It is about what works for you based on the aforementioned factors. But here are a few pointers to keep in mind which I promise will help you:

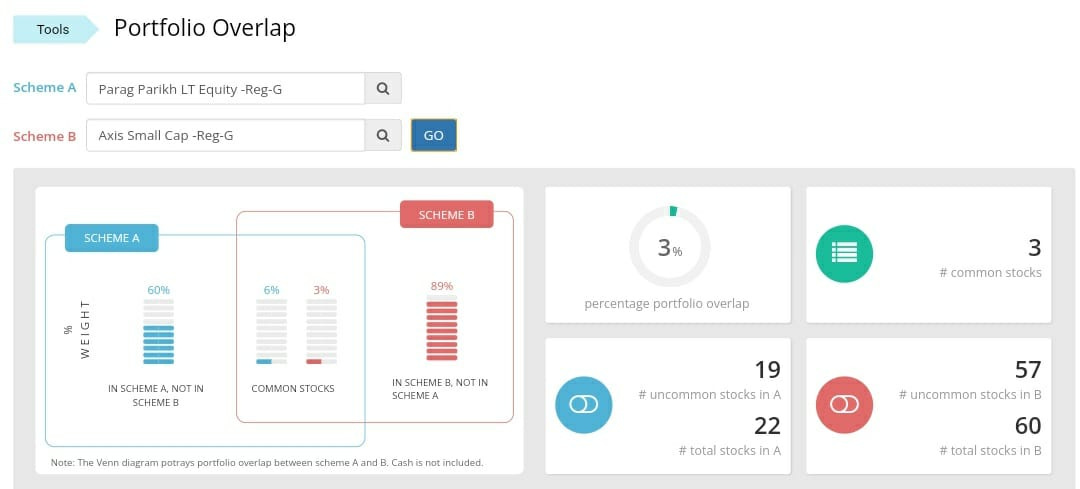

Avoid picking more than one fund from a particular category: There is no point buying two small-cap funds or two large-cap funds. While it may seem like they are different funds and have differences, most of them are usually overlapping. How do you find out if two funds have similar holdings?

Here’s the tool:

https://www.thefundoo.com/Tools/PortfolioOverlap

Here I have compared two schemes:

This tool spells out the overlap between the two funds, even displaying which stocks overlap and what is their composition percentage in each fund. An overlap of more than 20% usually implies it’s not worth investing in both funds. You would rather pick one and go ahead with a larger sum in that. Avoid over-diversification as it neither minimizes risk nor maximizes returns optimally.

Research about Flexi Cap funds: The fund which I compared above, the Parag Parikh Flexi Cap fund is one the most successful funds generating almost 25% annualized returns in the last 5 years. While the credit certainly goes to the fund manager but Flexi cap funds, in general, have more flexibility and options to themselves than traditional cap funds.

Check the AUM: AUM refers to assets under management. It is the money managed by the fund manager. Is it extremely important? Probably not. But in some situations, it can give good insights. Usually, funds with very high or very low AUM can be avoided. Why? Funds with very high AUM aren't flexible enough. Since they are responsible for a very large sum coming from 1000s of people, they are risk-averse and may not be able to take advantage of special situations. On the other hand, very low AUM funds are untried and may lead to excessive volatility.

While there is no fixed number, a good way to filter out in an absolute sense might be to avoid funds with >20k cr and<1k cr AUM. In relative terms, other funds of the same category can be compared. Just to reiterate don’t pick or avoid a fund purely based on AUM. But do take it into consideration.

Don’t overanalyze: It is the habit of investors to check their stock portfolio regularly. Every week, every day sometimes every hour as well(guilty as charged :D) But while there is a certain thrill to tracking stocks every day, the same shouldn’t be done with MFs. While the good thing is that NAVs(Net Asset Value i.e the price of one unit of a fund) are updated only after the market closes, but avoid checking them daily.

The principle with MFs should be to do SIP i.e a systematic investment plan. Put aside a certain sum every month and invest in particular funds irrespective of where the market is. Following this practice for a few years is surely going to help you stay calmer and build wealth slowly but steadily.

Model Portfolio

I know it would become pointless theory if I don’t give an example and that’s not something I believe in. So a model portfolio for an aggressive investor with age on his side could probably include

1 Small-Cap Fund

1 Flexi Cap fund

1 Sectoral or Contra Fund

For a moderate profile, it could have:

1 Large Cap Fund

1 FlexiCap fund

1 Value or Dividend Yield Fund

A conservative profile could have:

1 Large Cap fund

1 ELSS Fund

1 Dividend Yield Fund

This comes from just my understanding of how mutual funds can work. You can go ahead and create multiple permutations. There are also other major categories of mutual funds such as debt, hybrid, and international funds which I will cover in a different piece( i know this has already been too long :D) But 3-4 equity funds are probably a good mix to have.

Where to research more about mutual funds?

Mutual fund Sahi hai isn’t just an ad, they have a legit website too. It is a great place to explore and look at various options Check out their website here- mutual fund sahi hai

I also use Zerodha’s COIN and Groww to research. While Coin has various funds filtered in categories wonderfully, Groww provides exquisite details such as the fund manager’s past performance, peer comparison, etc. I feel you must explore these two apps in depth.

That is it for this week. Thank you for reading if you’ve reached this far. Hopefully, the wait of the last 3 months was worth something in this piece. I love stocks, but I have also come to love Mutual Funds. They aren’t just for our parents you know :)

What better time than the New Year to begin a new SIP?

On that note, wish you Merry Christmas and a Very Happy New Year :)

P.S If you enjoyed and learned something from this piece, please be my Secret Santa, and share this so that it can reach maximum people :)

Good Stuff Ishaan! Cleared a lotta doubts. Gg🚀

Remarkably well written. Informative and executable. Well done.